Coupon Bonds Sample Problems . — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. Consider a $1,000 par value bond with a 7 percent annual coupon. Then, if interest rates have. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. Learn how to calculate the price,. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. The coupon rate is the yield.

from www.chegg.com

Then, if interest rates have. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. Learn how to calculate the price,. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. Consider a $1,000 par value bond with a 7 percent annual coupon. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. The coupon rate is the yield.

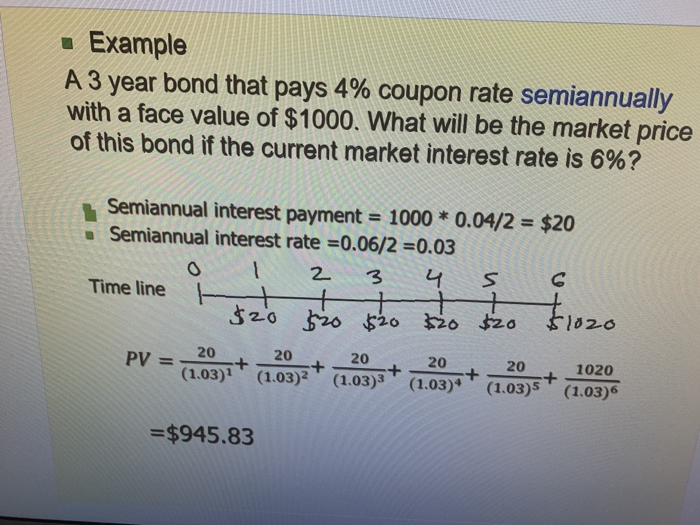

Solved Example A 3 year bond that pays 4 coupon rate

Coupon Bonds Sample Problems this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. The coupon rate is the yield. Consider a $1,000 par value bond with a 7 percent annual coupon. Learn how to calculate the price,. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. Then, if interest rates have.

From efinancemanagement.com

Deferred Coupon Bonds Definition, How it works? Types, Advantages Coupon Bonds Sample Problems ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. Learn how to calculate the price,. Then, if interest rates have. The coupon rate is the yield. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. a coupon bond is a debt instrument that. Coupon Bonds Sample Problems.

From studylib.net

Bond Problems Name 1. Coupon Bonds Sample Problems Learn how to calculate the price,. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. Then, if interest rates have. The coupon rate is the yield. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. — a coupon bond is a debt obligation. Coupon Bonds Sample Problems.

From www.chegg.com

Solved Problem 711 Zero Coupon Bond Price (LG74) Calculate Coupon Bonds Sample Problems a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. ecn 3321 bond price calculation practice. Coupon Bonds Sample Problems.

From www.chegg.com

Solved Question 1 Calculate the Accrued Interest on Bonds Coupon Bonds Sample Problems The coupon rate is the yield. Then, if interest rates have. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. Learn how to calculate the price,. Consider a $1,000 par value bond with a 7 percent annual coupon. a coupon bond is a debt instrument that pays fixed interest. Coupon Bonds Sample Problems.

From www.chegg.com

Solved Valuing semiannual coupon bonds Bonds often pay a Coupon Bonds Sample Problems Then, if interest rates have. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. The coupon rate is the yield. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. ecn 3321 bond price calculation practice questions calculate the price of a. Coupon Bonds Sample Problems.

From www.ferventlearning.com

Zero Coupon Bonds Explained (With Examples) Fervent Finance Courses Coupon Bonds Sample Problems Consider a $1,000 par value bond with a 7 percent annual coupon. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. Learn how to calculate the price,. — a coupon bond is a debt. Coupon Bonds Sample Problems.

From www.chegg.com

Solved 1. Exploring Finance Coupon Bonds Coupon Bonds Coupon Bonds Sample Problems Learn how to calculate the price,. Consider a $1,000 par value bond with a 7 percent annual coupon. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. The coupon rate is the yield. a. Coupon Bonds Sample Problems.

From www.slideserve.com

PPT Bond Valuation Problems PowerPoint Presentation, free download Coupon Bonds Sample Problems Then, if interest rates have. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. Learn how to calculate the price,. this web page provides a set of sample questions for the financial mathematics (fm). Coupon Bonds Sample Problems.

From exonkkfvc.blob.core.windows.net

How To Find Coupon Rate Of A Bond On Financial Calculator at Michael Coupon Bonds Sample Problems a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. The coupon rate is the yield. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. Consider. Coupon Bonds Sample Problems.

From www.chegg.com

Solved 6. Bond A is a 1year zerocoupon bond. Bond B is a Coupon Bonds Sample Problems ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. The coupon rate is the yield. Then, if interest rates have. Consider a $1,000 par value bond with a 7 percent annual coupon. Learn how to. Coupon Bonds Sample Problems.

From www.slideserve.com

PPT Bond Valuation Problems PowerPoint Presentation, free download Coupon Bonds Sample Problems Consider a $1,000 par value bond with a 7 percent annual coupon. Learn how to calculate the price,. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. Then, if interest rates have. The coupon rate is the yield. a coupon bond is a debt instrument that pays fixed interest payments and. Coupon Bonds Sample Problems.

From www.chegg.com

Solved Problem 1513 Prices of zerocoupon bonds reveal the Coupon Bonds Sample Problems this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. The coupon rate is the yield. Then, if interest rates have. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. a coupon bond is a debt instrument that pays fixed interest payments. Coupon Bonds Sample Problems.

From www.slideserve.com

PPT Chapter 6 Bonds PowerPoint Presentation, free download ID5589591 Coupon Bonds Sample Problems — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. Consider a $1,000 par value bond with a 7 percent annual coupon. Learn how to calculate the price,. Then, if interest rates have. . Coupon Bonds Sample Problems.

From www.studocu.com

Calculating the Holding Period Return on a Coupon Bond Is the same Coupon Bonds Sample Problems ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. Consider a $1,000 par value bond with a 7 percent annual coupon. The coupon rate is the yield. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. Learn how to calculate the price,.. Coupon Bonds Sample Problems.

From www.chegg.com

Solved A coupon bond that pays interest of 60 annually has Coupon Bonds Sample Problems — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. Then, if interest rates have. Consider a $1,000 par value bond with a 7 percent annual coupon. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. The coupon rate is the yield. ecn 3321. Coupon Bonds Sample Problems.

From studylib.net

Sample bond problems Coupon Bonds Sample Problems — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. ecn 3321 bond price calculation practice questions calculate the price of a bond with these characteristics. Consider a $1,000 par value bond with. Coupon Bonds Sample Problems.

From www.slideserve.com

PPT Chapter 4 PowerPoint Presentation, free download ID6551216 Coupon Bonds Sample Problems Consider a $1,000 par value bond with a 7 percent annual coupon. The coupon rate is the yield. — a coupon bond is a debt obligation with coupons attached that represent semiannual interest payments. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. Then, if interest rates have. ecn 3321. Coupon Bonds Sample Problems.

From www.slideserve.com

PPT FI 3300 Chapter 9 Valuation of Stocks and Bonds PowerPoint Coupon Bonds Sample Problems Then, if interest rates have. a coupon bond is a debt instrument that pays fixed interest payments and principal at maturity. this web page provides a set of sample questions for the financial mathematics (fm) exam, which is part. Consider a $1,000 par value bond with a 7 percent annual coupon. ecn 3321 bond price calculation practice. Coupon Bonds Sample Problems.